Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

We have had a few readers ask us “How do you protect your money on holiday?” So, this is an answer to that.

This is how to plan for a safe holiday – to protect yourself, your money and your family just in case the worst happens.

First things first – travel insurance. We say it over and over again and it seems obvious, but the Association of British Insurers say that one in four people choose to travel without it. Here’s the best tip we can give you – don’t be one of them!

Travel insurance doesn’t have to cost the earth if you shop around, and can you really put a price on your family’s safety or your own peace of mind?

Have a good read of our travel insurance article to find out how to get the best deal, what you should expect from your cover and loads more useful nuggets of information. As well as that, take heed of these tips:

Cheapest is not always best – check the policy carefully to make sure it provides you with adequate cover.

Cheapest is not always best – check the policy carefully to make sure it provides you with adequate cover.OK, that’s the tough stuff done. Read on to find out how you can hopefully avoid having to claim on your insurance.

Also see this – Travel: what you need to know before you go

Flight cancellations can cause major headaches. If your flight is cancelled and the airline can prove it was because of ‘extraordinary circumstances’ (which unfortunately includes the airline going bust), then you’re not entitled to compensation.

Flight cancellations can cause major headaches. If your flight is cancelled and the airline can prove it was because of ‘extraordinary circumstances’ (which unfortunately includes the airline going bust), then you’re not entitled to compensation.

However, you may still be able to get your money back if:

Essentially – make sure one (or preferably two) of these apply to you when booking your flight, then one way or another you’ll be covered if the worst does happen.

Under the Package Travel, Package Holidays and Package Tour Regulations 1992, all package holidays must be ATOL bonded.

Under the Package Travel, Package Holidays and Package Tour Regulations 1992, all package holidays must be ATOL bonded.

This means that if the airline or the travel agent go bust before you travel, your money will be refunded and if you are already away, the Civil Aviation Authority will make sure you get home.

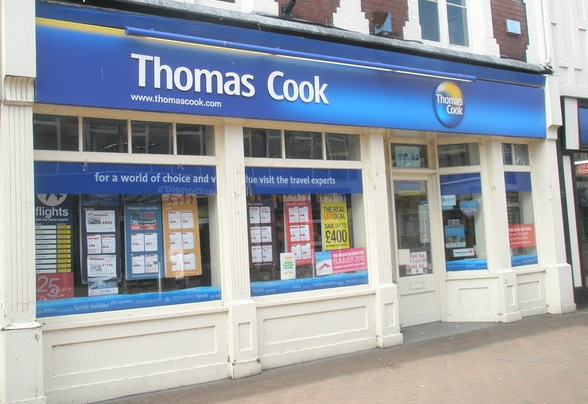

Always make sure that you book with a travel operator who is a member of ABTA (The Association of British Travel Agents) or AITO (The Association of Independent Tour Operators). This will also protect you from travel companies getting into financial trouble.

Of course, it is still always best to check when booking what protection is included.

Unsurprisingly, the majority of credit card fraud occurs abroad, so you’ll need to be extra careful if you decide to take your cards with you.

Unsurprisingly, the majority of credit card fraud occurs abroad, so you’ll need to be extra careful if you decide to take your cards with you.

If you do take a credit or debit card with you, make sure you store the card company’s ‘lost and stolen’ number in your phone, and make of note of it somewhere else too.

You should also consider signing up to a card protection service. You pay a small fee – usually about £20 – and register the details of your cards and other important personal documents such as your passport.

That way, if anything does happen, you’ll just have to ring one number and they can do everything needed, like cancel the cards and order replacements.

Another thing to remember if you’re going to take your credit or debit card abroad is that most will charge you when you use them overseas. Contact your provider for details of these charges.

There are several prepaid cards out there specifically designed for foreign travel. You have to purchase the card (although you can get some for free) then you simply choose which currency you want your card in (euros, US dollars or sterling) and you can load it with as much as you want.

Remember that you can only spend the money that’s on the card – so once it’s gone, it’s gone.

If you do take a credit or debit card with you, make sure you store the card company’s ‘lost and stolen’ number in your phone, and make note of it somewhere else too.

Save Instead

Save InsteadYou could, of course, put booking your holiday on hold for a while and put the money aside instead. Get the best rate of interest you can in this tough financial climate and watch some interest accrue on your hard-earned cash until a bit nearer the time you want to go away.

To find out more about how notice savings accounts work, click here.

You would think that while your credit cards are in your purse or wallet they are safe.

Sadly that’s not always the case. It’s possible for people to use a ‘reader’ to take your card details through your wallet.

This sort of thing can happen anywhere, but it’s particularly rife in tourist spots, obviously enough. So protect your cards by having a specially-lined wallet such as the ones by designer Shona Easton. This one – the Bertie purse – is typical of the genre. This purse has been designed with special metal, ‘card-guard’ blocking interlining in the body of the purse, so you can be sure that your contactless credit cards are protected from scanning devices. It costs £79, is made of leather and comes in four colours.

This sort of thing can happen anywhere, but it’s particularly rife in tourist spots, obviously enough. So protect your cards by having a specially-lined wallet such as the ones by designer Shona Easton. This one – the Bertie purse – is typical of the genre. This purse has been designed with special metal, ‘card-guard’ blocking interlining in the body of the purse, so you can be sure that your contactless credit cards are protected from scanning devices. It costs £79, is made of leather and comes in four colours.

Also, see here how to get the cheapest foreign currency

In most holiday destinations, there’s no reason to suspect you’re in any more danger than in the UK. Having said that, when you’re somewhere unfamiliar and you’re obviously not one of the locals, it’s always better to be safe than sorry.

In most holiday destinations, there’s no reason to suspect you’re in any more danger than in the UK. Having said that, when you’re somewhere unfamiliar and you’re obviously not one of the locals, it’s always better to be safe than sorry.

A document wallet is a really good idea if you’ll be staying in hostels or more budget hotels that don’t have a safe. They fit comfortably and easily under your clothes, without being obvious.

If you have to carry documents like your passport around with you, this is the best way to keep them safe.

Make sure you make copies of all your essential documentation, take some with you and leave some with friends or relatives at home. Just to be extra safe, it’s worth scanning the copies and emailing them to yourself. That way, you’ll always have access to them in an emergency.

Find out here how to stay connected on your travels