Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

Disclaimer: I have been paid by Wave for my review in this post, but these views are my own.

I think we can all agree that the last few years have been financially challenging. With the increase in costs, furlough and reduced pay, and now an energy price hike on the horizon, I for one have felt the constant pull of financial anxiety.

With this looming over me, I was genuinely pleased when set the work assignment to look into the new credit card – Wave. The card launched a few months ago, and what excited me most was the fact it showed me the credit limit and APR that I was eligible for up-front which was competitive and it was 100% pre-approved, subject to me passing the affordability and security checks..

Now, ‘credit score’ is a tricky one for me. I can admit I wasn’t educated on this at all and was raised to believe credit cards were the route to bad finances, and that I shouldn’t borrow money from banks at all. It therefore came as a shock when I went to look into getting a car loan and found that I had a low score. How?! I had been good as gold. I immediately called a close friend who is an ombudsman (lucky me) and told her my situation, and she told me that to improve my credit score, I in fact needed to show I could handle repayments.The fact I had zero credit on file was actually a detriment to lenders. My friend recommended I get a credit card and religiously keep on top of payments. She said that in no time, this would show as an improvement on my file and make me much more lender-friendly.

So, back to Wave. Initially recommended due to its lending appeal for people with all credit scores, I decided to take the plunge when I found out that getting a quote wouldn’t affect my credit score. Before this I’d been scared to even do a credit check because I thought it would lower my score further. Having done some proper research, I now know that just checking your credit score won’t damage it. But checking if you’re eligible for things like credit cards and loans can, unless the provider only uses a ‘soft search’ which doesn’t leave a mark on your credit file. It’s different when you apply for a product – then a company will add this information to your credit file and your credit score may get temporarily bumped down (it may come back up again when you show that you can manage repayments responsibly). This is called a ‘hard search’ because details are left on your credit file. However, some companies will add that you’ve applied for credit even when you’re declined, so doing this multiple times to then be told you’re not eligible was a worry for me. But it was explained that Wave doesn’t do the hard search until after I confirmed that I wanted the card, which is why it wouldn’t affect my credit score until I was ready to go ahead. Phew! Not only would Wave tell me what I was eligible for up-front without it impacting my credit score, I could use my card within 10 minutes of applying if I passed all the relevant checks: news that came as music to my ears the week before payday. Now, I’m not advocating that you all go out and take on credit that you can’t afford – you should only do this if you can genuinely afford to make the repayments.

After a very quick initial sign-up, I was sent a link to their app. I decided to go in at the deep end and sign up in the supermarket, partly because I had forgotten my debit card and partly to see if it was as easy (and safe) as the price comparison site said. The truth is, it was very easy. After downloading the app within seconds, I had to fill out some very basic details, read through the documentation and send over a photo of an approved ID. I went with my Driver’s Licence because it’s always in my wallet. If I’d left it at home, I would have been able to save my profile and return to it later. One thing is that you do have to have up-to-date ID. So a passport, driver’s licence or national identity card, but it has to be up to date: without this you wouldn’t be able to apply at all. This is the only potential obstacle I saw in the entire process.

I then had to send a quick selfie to show that I was the person on the licence. My partner had a good laugh when I reapplied my lippy to do this: pretty sure they’re not looking for the Instagram glamour shot here. After this, I was told to answer a couple more questions and then they reshowed me my initial credit limit and APR. I was happy with all the information and so signed the credit agreement in the app. I signed up to pay by Direct Debit and chose the day after payday to pay my bill. I actually like the fact I was given the choice because it means I won’t miss a payment.

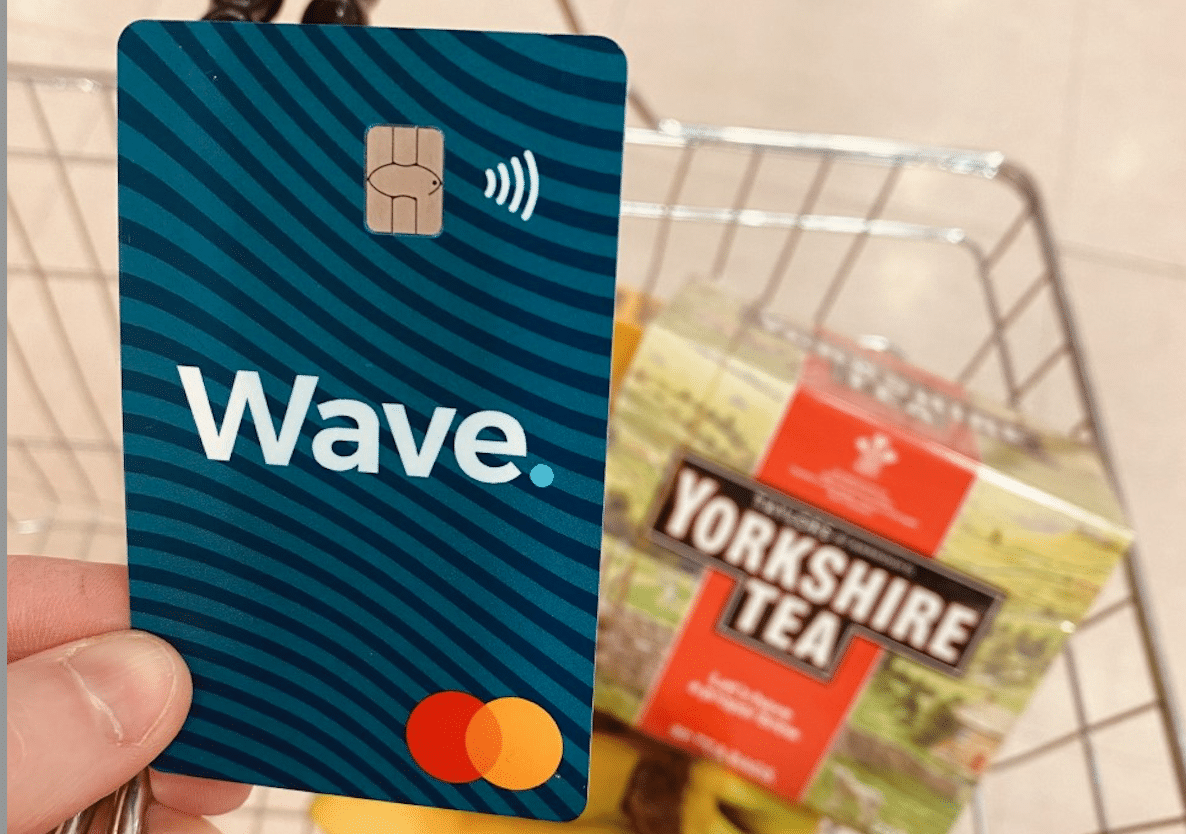

I was then asked if I would like to set up Apple Pay and they also told me I could access my temporary digital card in my Wave app until my plastic card arrived. This was so I could use it online, or from my digital wallet (Apple Pay) using my phone, which was something I hadn’t seen before. It meant I had immediate access, which, considering I was setting the app up to be able to do my weekly shop, was extraordinarily fast and helpful.

It took me about seven minutes. The fact that every part was done up front meant that it did maybe take a couple of minutes longer than when you request a form from your bank. But it meant that I had nothing else to do later on. From starting the process to spending the money was definitely less than ten minutes.

Within ten minutes of starting the process I had set up Apple Pay (on my phone) and was at the checkout using my phone to pay. In the past, when I’ve signed up to any sort of bank or service, I’ve had to wait for a card, so this immediate access was genuinely impressive.

I can’t see how it could be faked. The fact you have to send a selfie and ID and security codes meant that even though it was fast, it covered every security check I can think of. I always get a bit nervous with security questions because I feel that the information isn’t exactly impossible to find. First pet, for example, could be all over Instagram. Anyway, the security steps made it feel as safe as possible, even if I did feel a bit of a wally taking a selfie in the cheese aisle.

I was offered £750 credit due to my credit score (I think you can get up to £1,200). I chose to be notified when my credit limit can be increased so I can decide if I want it or not. I’m managing it so well at the moment I’m not sure if I’ll take it, but it’s great to have the option. I really appreciate having the choice up-front so that I can stay in control. I have paid a little over my minimum repayment each month and find the regular text updates and repayment calculator from Wave very helpful. All in all, I can’t fault the process. The physical card arrived within days of sign-up, but being able to use a temporary digital card online and on Apple Pay in advance of this was a real coup.

33.9% APR representative variable. Based on an assumed credit limit of £1,200. 33.9% p.a. variable.. As with all responsible lenders, credit with Wave is subject to status. UK applicants aged 21 and over may apply. There is no annual fee. More information can be found here

Had an email to say I’m owed a refund for fees and charges taken in error, called in and gave my bank details as my card is already closed after I paid it off in full, was told 3-5 working days, over 10 days later I’m still waiting for this refund, all I’m told is “the finance team do advise to wait at least 10 working days”. Wave was quick to take my money when I owed them but when it comes to them owing me money I have to wait.

Dont take this card out, its by Chetwood Finance. I had one and now theyve closed the Wave card so it cannot be used any more and the debt has to be paid off.

Im going to try this!

awesome, thanks for sharing. I really need this at the moment so hoping it’s good