Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

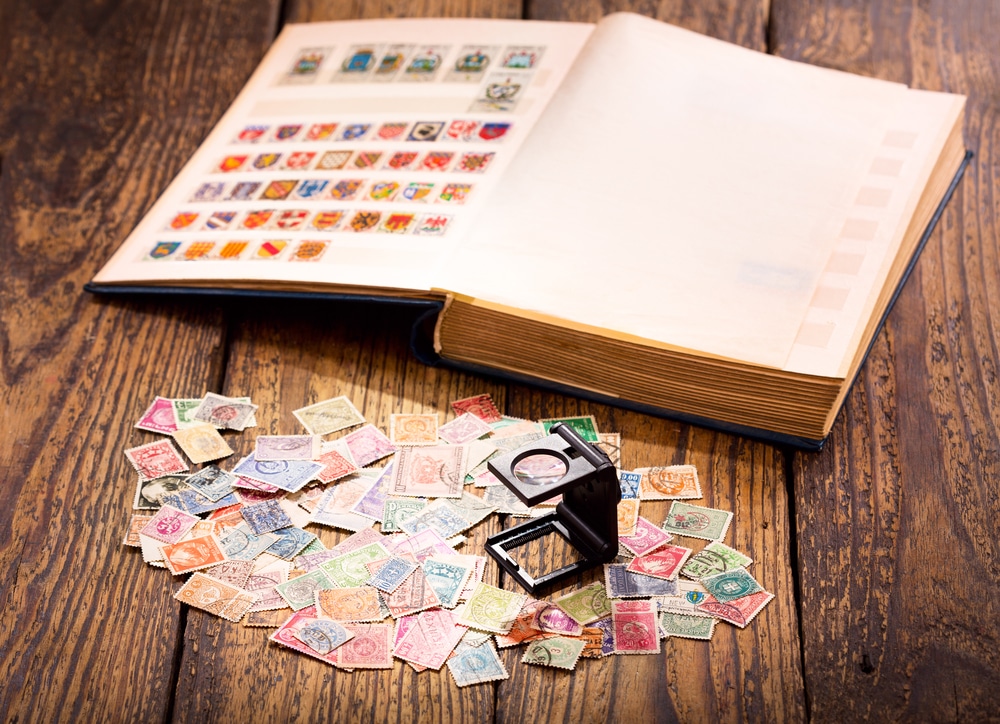

Have you ever considered to invest in stamps? It sure sounds a bit odd.

Collecting stamps is one thing, of course. Maybe your dad was a fan and kept trying to get you interested. But why invest in them?

You might be wondering how valuable a stamp could be.

The answer is: very valuable. A British Guiana One-Cent Magenta stamp set a world record selling for $9.48 million.

If you’re looking to invest in something different, stamps are often considered a reliable investment. Here’s a step by step guide on how to invest in them.

Stamps might not sound like a great investment. In fact, many people at first confuse investing in stamps with stamp collection.

However, those who collect stamps are interested in philately, which is the study of stamps and postal history.

Collectors aren’t particularly interested in the monetary value of stamps. They enjoy collecting.

For investors, only a tiny percentage of stamps are valuable.

But, even so, why can investing in stamps pay dividends?

A lot of investments are related to the state of economy. So, if the economy is struggling, shares and property, for example, might lose their value. Stamps are largely unaffected by the economy. Instead, they depend on the demand from buyers. This means stamps can retain their value even when other investments struggle.

Prices have risen steadily over the past 10 years, growing by 133.5% in the past decade. That’s a compound annual growth rate of 8.8%, according to Stanley Gibbons investment GB250 Index, which tracks the performance of the top 250 investment-grade British stamps. What’s more, during the financial crash of 2008-2010, the value of stamps actually increased by 17.7%.

Each valuable stamp can tell its own story and is of historic significance. Many investors find satisfaction in investing in a tangible and significant item as opposed to a share.

… and not income tax.

Income tax has a top rate of 45%. Meanwhile, capital gains tax has a top rate of 28%.

You should be aware, however, that stamp investments aren’t covered by the Financial Conduct Authority. This means you’re not covered if you lose money on your investment. That’s the case with quite a few types of investments, particularly collectibles.

You also shouldn’t let stamp investing become a big part of your investment portfolio. Stanley Gibbons, a company that specialises in everything to do with postage stamps, recommend it should be no more than 10% of your portfolio.

This is a key point when it comes to finding out how to invest in stamps to make sensible money.

The simple answer is: however much collectors are willing to pay for it.

Bearing that in mind, you should only invest in stamps a healthy number of collectors want. And will want in the future, as far as you can tell.

Collectors are interested in three things.

How rare is the stamp? As you’d expect – on the whole – the rarer the stamp, the more it’s worth.

If you’re looking to make a profit with any form of collectible, condition plays a vital role. Stamps are “graded” to describe condition and value. This can range from “superb”, where the stamp is considered perfect in all respects and the finest quality, to “poor”, where the stamp itself may be torn or damaged, or the design is off-centre. To gauge the condition of the stamp, check for colour fading, the edging and the state of the gum on the back of the stamp.

You’ll need to prove your stamp is authentic. Make sure you get a certificate from a trusted organisation or seller when buying your stamps.

A good example of a stamp to look our for is the Penny Black. They’re well regarded and likely to be a good investment, but they’re not actually rare. You can get one for as little as £10.

As always when investing, look to buy low so you’ll eventually be able to sell on at a profit.

There’re two ways to invest in stamps.

You can now buy a single portfolio of stamps, much as you’d buy a single investment fund holding a collection of stamps. These are available from companies such as Stanley Gibbons, which offers various “capital protected” investment plans.

They allow you to buy a portfolio of stamps of five and seven rare stamps. You can keep them at home or store and insure at the firm’s secured vault. The minimum price for investing is £10,000 for a period of five to 10 years. When the term is up and the stamps haven’t risen in value compared to those listed in the Gibbons catalogue, the company will refund your money. However, if there’s any growth when you come to sell, it will take 20% of the profit.

Bear in mind that like other “alternative assets”, this type of investment is an unregulated area. Your money isn’t protected by an ombudsman or compensation scheme, nor is the company’s marketing literature regulated. Like all investments, this type of “capital protected” investment plan can go up as well as down. Only take money that you can afford to lose.

The second way is rather old fashioned. Go and buy stamps yourself – then sell them on for a profit either through a broker or privately. If that’s your plan, your first port of call should be Ukphilately.org.uk for advice.

The site is sponsored by the National Philatelic Society. It tells you everything you need to know about buying and selling stamps.

Stamp auctions are a great way for philatelic traders and stamp collectors to buy and sell stamps. Making bids online has the advantage of reaching a wider range of stamps on offer as you can bid on auctions across the country from the comfort of your own home. What’s more, you’re less likely to get caught up in the atmosphere of the auction and find yourself over bidding and blowing your budget.

Auctioneers which offer online bidding include warwickandwarwick.com and sandafayre.com.

Another route to amassing a stamp collection is to attend a specialist fair where you’ll find a large number of dealers under one roof. Listings of fairs and their organisers appear in the main monthly stamp magazines and you can find them online at the UK Philately site. Some stamp fairs are organised by local Philatelic Societies, and include not only dealers, but displays and competitions as well. One of the biggest fairs is Stampex held every spring and autumn in London.

Remember: if you’re storing the stamps yourself it’s up to you to keep them in the best possible condition. Any damage can be devastating to a stamp’s value – if not destroy it completely. Knowing how to invest in stamps definitely includes knowing how to preserve them!

Also find out here how to make money by buying and selling Ladybird books.

No matter how carefully you’re caring for your stamp collection, accidents can – and do – happen. According to Hiscox insurance, less than 5% of stamp collections are insured. Make sure that you’re covered should the worst happen. And get the right cover.

Before you approach an insurer, it’s vital to get your collection valued. A stamp dealer may be your first port of call. Alternatively, you can approach your local auction house. Prices for identification and valuation services range from around £150 with local auction houses to over £1,000 for a day-long home visit by a major auctioneer.

As a collector, you should bear in mind that some collections can reach a high value very quickly. That can soon take you over the standard home contents insurance limit.

While most home contents insurance policies provide an element of cover, they’ll most likely have a limit that’ll be paid out on damage to collectible items. Speak to your insurer before taking out a policy. It can be often amended to cover a high-value collection.

If your home contents policy won’t provide the right level of cover, opt for a specialist insurers such as Hiscox, Ecclesiastical or Assetsure.

Another key element of learning how to invest in stamps is learning when to sell – and who to sell to.

Stamps aren’t a highly volatile market. They tend not to go up or down in price at any great speed. This is why you shouldn’t be investing in stamps if you’re going to need your money within a couple of years.

Stanley Gibbons recommend your investment should be at least five years. Ten years would be the ideal minimum.

When you come to sell your collection – or individual stamps – speak to a specialist to get it valued. Then work out the best way to sell it.

Relatively low value stamps can be sold at stamp fairs, stamp shops, shows and exhibitions, and also online. If it’s a stamp with astonishing value, it may even be best to sell it through one of the big auction houses such as Christie’s or Sotheby’s.

Is investing in stamps something that interests you?

Let us know in the comments section below.

Worth noting here by way of update that Stanley Gibbons’ investment arm has gone into administration.

Tuvan people’s Republic (1942-1944). rare stamps analogues of such no 2; pieces there are others [email protected]

Good evening

Hope all is well?

For Russian stamps you can contact Cherrystone Stamp Auctions in New York, they are dealing in Stamps for the past 50 years started in 1967, both owners, two brothers are from Russia itself.

Hope the information helps.

Kind regards

Meintjes

Hi, I am what you might call a ‘casual’ stamp collector. Approx 20 years ago my brother gave me a substantial collection of Russian stamps in an album. He was working in Russia at the time and traded them for other items. Should I have them looked at and valued? Do you know of a site that deals in Russian stamps only, so as to compare and see if I have anything worth keeping for my grandchildren. Also, is it true that Russian collector(s) are now trying to get back everything ‘Russian’, back to Russia? Grateful for any advice you… Read more »

Yes i think you should be getting these valued. Go to Stanley Gibbons in London or Spink and they will be able to tell you what they’re worth.

I don’t know of a site that deals in Russian stamps only but I think the big dealers like the ones above will be able to tell you all about Russian stamps. there are some Russians – as Chinese – who are going for Russian artefacts only, but I don’t know how many of them there are and whether they are as interested in stamps as they are in art.