Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

When it comes to saving money it’s all about cutting costs and finding the right discounts, offers, vouchers and sometimes even freebies. From saving on the cost of your gym membership and kids entertainment to paying attention to your spending habits and saving money with travel, insurance and bills, we have 26 ways for you to save money and enjoy the benefits along the way.

Take a look at our A-Z guide to saving money below.

It may seem like an obvious one to start with but far too many people in the UK have to worry about debt on a daily basis.

It may seem like an obvious one to start with but far too many people in the UK have to worry about debt on a daily basis.

Take a look at our tips on how to avoid debt and click below for Jasmine’s video guide to getting out of debt.

There’s big money to be saved from group discounts, free extras and simply buying in bulk.

The MoneyMagpies are strong advocates of buying in bulk to save money. Also, you can get great discounts by joining group-buying sites like Groupon, Mighty Deals and Go Groopie. These sites offer great discounts and can send them straight to your inbox because a large amount of people are committing to the sale.

Read our full article on group-buying sites for more information.

It’s quite simple really; the less you spend, the more you’ll save. And, more importantly, the more you’ll be able to put into investments for your future.

It’s quite simple really; the less you spend, the more you’ll save. And, more importantly, the more you’ll be able to put into investments for your future.

See our tips for cutting your heating costs here, how to cut your driving costs and how to cut your holiday costs for starters.

Designer clothes, shoes and handbags are more often than not worth the money – especially if you’re trying to save money.

Designer clothes, shoes and handbags are more often than not worth the money – especially if you’re trying to save money.

But if you can’t live without your designer fashion you must search around for the best deals to make your money go further.

Here at MoneyMagpie we like Brand Alley, where you can get between 30% and 70% off loads of designer labels and receive £10 when you refer a friend who goes on to buy something. If you’re looking for the latest designer beauty brands take a look at this article for our pick of the top 10 money saving beauty websites.

If you’re struggling with ideas on how to entertain the kids, here are some cheap (and occasionally free!) holiday activities for children. Also, some cinema chains such as Cineworld offer £1 tickets on Saturday mornings for both parents and guardians. So if you need a little entertainment for the kids, check out our guide to cheap cinema herehttps://www.moneymagpie.com/save-money/cinema-deals-discounts-and-offersfor latest offers for the upcoming weekend.

If you’re struggling with ideas on how to entertain the kids, here are some cheap (and occasionally free!) holiday activities for children. Also, some cinema chains such as Cineworld offer £1 tickets on Saturday mornings for both parents and guardians. So if you need a little entertainment for the kids, check out our guide to cheap cinema herehttps://www.moneymagpie.com/save-money/cinema-deals-discounts-and-offersfor latest offers for the upcoming weekend.

Cut your heating costs now by making a few simple changes to your home before the really cold weather comes. With energy prices higher than ever, making your home as energy efficient as possible can save you serious money and ensure you stay warm for less. Click here for advice on easy ways to cut your bills.

Cut your heating costs now by making a few simple changes to your home before the really cold weather comes. With energy prices higher than ever, making your home as energy efficient as possible can save you serious money and ensure you stay warm for less. Click here for advice on easy ways to cut your bills.

Also, see our plan for getting cheaper fuel by joining together and getting the utilities companies to bid for our custom. Here’s how to do it.

If you’re finding that you don’t work out as often as you intend to and you’re paying over the odds for your membership, now’s the time to do something about it.

If you’re finding that you don’t work out as often as you intend to and you’re paying over the odds for your membership, now’s the time to do something about it.

Gyms are often open to negotiating the prices of contracts – but they’re more likely to cut you a deal at times when they aren’t selling so many memberships. Here are our 12 top tips to finding cheaper fitness fees.

If you want to buy your own at home gym equipment visit SportsandLeisure

Trimming the fat off wasteful habits can really add up to savings of £100s. We could all do with cutting down our household expenditure by making small changes to everyday life.

Trimming the fat off wasteful habits can really add up to savings of £100s. We could all do with cutting down our household expenditure by making small changes to everyday life.

We’ve come up with 50 ways your can reduce your spending and start saving at home – take a look here. Start having a go at just half of them and you’re bound to save a packet.

If you have an ongoing debt on a credit card that’s currently charging you interest… then a 0% interest balance transfer card could really help you to clear the debt. The top one is the Barclaycard 0% balance transfer card which gives you 0% interest on balance transfers for 34 months!

If you have an ongoing debt on a credit card that’s currently charging you interest… then a 0% interest balance transfer card could really help you to clear the debt. The top one is the Barclaycard 0% balance transfer card which gives you 0% interest on balance transfers for 34 months!

Sign up to our newsletter and every week you’ll get money saving (and money making) tips, offers and deals. It’s free so you don’t have to pay a penny and when you sign-up you’ll also

Sign up to our newsletter and every week you’ll get money saving (and money making) tips, offers and deals. It’s free so you don’t have to pay a penny and when you sign-up you’ll also

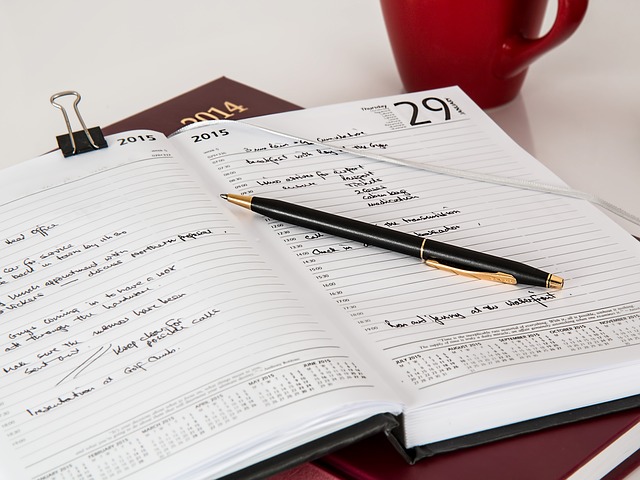

When it comes to savvy saving, the reason why most people fail is because they have no idea what is going into their bank account each month, and even less about what’s flowing out. The easiest way to keep track of what your spending is to write it down. Seems simple? That’s because it is. Keeping a spending diary is a great way to save money and get rich – click here to find out how to get started.

When it comes to savvy saving, the reason why most people fail is because they have no idea what is going into their bank account each month, and even less about what’s flowing out. The easiest way to keep track of what your spending is to write it down. Seems simple? That’s because it is. Keeping a spending diary is a great way to save money and get rich – click here to find out how to get started.

Did you know that the average worker spends about £7 per day on lunch, adding up to around £35 each week? Keep going and you are at almost £1,820 each year. By the end of your career you would have spent over £50,000 just on buying lunch! Save money by making your own, and for handy hints on packing your lunch and yummy food ideas see how you can make your lunch money go further.

Did you know that the average worker spends about £7 per day on lunch, adding up to around £35 each week? Keep going and you are at almost £1,820 each year. By the end of your career you would have spent over £50,000 just on buying lunch! Save money by making your own, and for handy hints on packing your lunch and yummy food ideas see how you can make your lunch money go further.

There are loads of mobile networks out there and they are all fighting over your business. That means you’ve got the upper hand. The average mobile bill spend is £35-40. If you are paying more than this you shouldn’t be. Get on the phone to your provider and see if you can get a cheaper deal. If they won’t play ball, find a new contract using a free mobile comparison service. You don’t have to spend as much as £35. If you’ve already got a decent phone, the SIM-only tariffs are such good value for money. They’ll get you loads of minutes and texts for as little as £15 a month.

There are loads of mobile networks out there and they are all fighting over your business. That means you’ve got the upper hand. The average mobile bill spend is £35-40. If you are paying more than this you shouldn’t be. Get on the phone to your provider and see if you can get a cheaper deal. If they won’t play ball, find a new contract using a free mobile comparison service. You don’t have to spend as much as £35. If you’ve already got a decent phone, the SIM-only tariffs are such good value for money. They’ll get you loads of minutes and texts for as little as £15 a month.

Food prices have rocketed since the recession, although they have levelled off in the last year. But it’s still tough for everyone to buy nutritious food on a budget.

Food prices have rocketed since the recession, although they have levelled off in the last year. But it’s still tough for everyone to buy nutritious food on a budget.

See our article on saving money on your food shopping without losing quality for useful tips.

House swapping is a fantastic way to have a holiday for less. This is probably one of the best money-saving tips, because as well as economising big-style you will also get a much more authentic experience of the place that you are visiting.

House swapping is a fantastic way to have a holiday for less. This is probably one of the best money-saving tips, because as well as economising big-style you will also get a much more authentic experience of the place that you are visiting.

If you organize your swap through a reputable company NO money should pass between you and the person you’re swapping with. For more house swapping tips and advice read our article here.

Why pay more for your travel money at the airport or paying sky high rates using your debit card overseas? Make your spending money go further with prepaid cards.

Why pay more for your travel money at the airport or paying sky high rates using your debit card overseas? Make your spending money go further with prepaid cards.

There are many reasons why your should quit smoking; for your health, for your social life and for your wallet. We know it’s not an easy thing to do, but quitting smoking can save you around £3,000 a year. Think what you could buy with that!

There are many reasons why your should quit smoking; for your health, for your social life and for your wallet. We know it’s not an easy thing to do, but quitting smoking can save you around £3,000 a year. Think what you could buy with that!

Boots also have a great quit smoking scheme and a range of useful products to help you too – click here to see their full range.

It cannot be said too many times; if you want cheaper flights with the major airlines, especially long-haul, then you should try and get in as early as possible. Over a matter of weeks or sometimes days, prices can change immensely. Planes, trains and buses all have a quota of seats they will sell for the lowest price and then prices just increase. For more advice on travel saving look here for 50 money-saving holiday tips. If you can’t book early for whatever reason, take a look at Lastminute.com who have a range of cheap last minute travel deals.

Pour yourself a nice cuppa and settle down with your computer to switch everything. Get the best deal on your gas and electricity, all your insurances, your phone and broadband providers and even your bank. Over the next year you should be able to save around £1,000 by doing this.

While most of us have to pay tax in some form, there’s no need to pay any more than you need to. Britons waste billions of pounds every year paying too much tax. Remember, we’re not talking about tax evasion, which is illegal, but tax avoidance – big difference. Here we have five (completely legal) ways to pay less tax and save yourself some money too.

Sounds dull, but doing a budget – even a basic one – will help you save and, importantly, help you build up your wealth. Seriously, all the very rich people started with a budget.

Sounds dull, but doing a budget – even a basic one – will help you save and, importantly, help you build up your wealth. Seriously, all the very rich people started with a budget.

Budgeting and living within your means is about prioritising the important stuff and cutting back on the rest. See our full article on making a budget here.

The good news is that you’re already saving money by shopping online – but with a voucher code to cut costs even further, you’re laughing. Voucher codes are all the rage these days but making the most of them can be tricky. To help out, we’ve pulled together the best ways to maximising savings, complete with insider tips and a four-step guide to being clever with codes. Take a look at our guide to being clever with voucher codes here.

The good news is that you’re already saving money by shopping online – but with a voucher code to cut costs even further, you’re laughing. Voucher codes are all the rage these days but making the most of them can be tricky. To help out, we’ve pulled together the best ways to maximising savings, complete with insider tips and a four-step guide to being clever with codes. Take a look at our guide to being clever with voucher codes here.

Now admittedly this might not save you money right now but it will certainly save your kids, friends, charities etc later on. If you write a will and keep it updated then there’s less for them to pay in solicitor’s fees, tax and all sorts of other expenses. You should have a will NOW if you have any sort of assets (car, bit of money, clothes, jewellery, pension) and any family or friends you want to give it to. Here’s how to get a good will done.

Now admittedly this might not save you money right now but it will certainly save your kids, friends, charities etc later on. If you write a will and keep it updated then there’s less for them to pay in solicitor’s fees, tax and all sorts of other expenses. You should have a will NOW if you have any sort of assets (car, bit of money, clothes, jewellery, pension) and any family or friends you want to give it to. Here’s how to get a good will done.

We know that right now, Christmas is probably the last thing you want to think about. But, if you want to make a start on saving for Christmas 2016 or 2017 then we can help you to start cutting the costs and making a bit extra to pay for it all. Follow our top tips and you’ll have next Christmas wrapped up in no time!

We know that right now, Christmas is probably the last thing you want to think about. But, if you want to make a start on saving for Christmas 2016 or 2017 then we can help you to start cutting the costs and making a bit extra to pay for it all. Follow our top tips and you’ll have next Christmas wrapped up in no time!

The best way to save money is to spend nothing at all. Here at MoneyMagpie we’re always on the lookout for a good freebie. See our article on 50 ways to live for free here and this article on how to get the best freebies, deals and vouchers.

The best way to save money is to spend nothing at all. Here at MoneyMagpie we’re always on the lookout for a good freebie. See our article on 50 ways to live for free here and this article on how to get the best freebies, deals and vouchers.

We’ve also got a freebies newsletter to take all the effort out of finding freebies.

Sign up to our freebies newsletter to get freebies delivered to your inbox every week.

Once a week try having a zero spend day. Use your local library for books, magazines, music and film. Use your points to buy things such as Boots or Superdrug cards for toiletries, Tesco Clubcard for dinners in restaurants and Avios for a trip to a theme park. Use food you have already in the kitchen to make a picnic and have a family outing in the park for free. Find out how to live for free with loyalty and rewards cards to help you.

I have learnt the hard way – loyalty does NOT pay. I will shop around regularly now for all my contracted services – Insurance, electric, phone etc. This really is a huge saving! and BARTER them down even more – don’t ask = don’t get.

I do my supermarket shopping in the evenings to get all the reduced bargains.

Take advantage of local “Give and Take” & Recycling days, you can take in all the stuff that you no longer use or need and come home with things that you do want instead – all for free. Good for the environment and your pocket. You can usually find these type of events through your local Freecyle or your local council. Never buy anything with a credit card unless you already have the money to pay it off in full at the end of the month. Always buy the reduced items at the supermarket and freeze them. It saves a… Read more »

avoid waste is another important thing to do to cut costs – we waste water, food, heat, fuel…

Car boot sales are a great way to buy and sell at a profit. You have to be up early though!

I try not to buy too many drinks or meals on the go such as a starbucks on the way to work or a sandwich at lunch time because the price adds up and they’re not really necessary

So important avoid DEBT

I choose ‘own label’ products in the supermarket. Just as good as branded items and often up to half the price.

Don’t buy too much of what your not going to use…and if it’s sports equipment etc..make the effort to use it… (which I know is not always easily done!)

Always by certain Xmas gifts in January sales – perfume, xmas paper, crackers etc. It saves time at Xmas too!