Jasmine Birtles

Your money-making expert. Financial journalist, TV and radio personality.

You may have noticed some chatter lately about the ‘inverted yield curve’ and be wondering to yourself – ‘what is this financial voodoo mumbo jumbo?’. Well, people are talking about this in the UK and abroad because it’s a potential signal for an incoming recession.

This guides explains everything you need to know about this complex sounding term and its link to recessions. You’ll also learn about what a recession could mean for the stock market and how you can invest and make money during these times.

Keep reading for a full breakdown or click a link below to jump straight to a specific section…

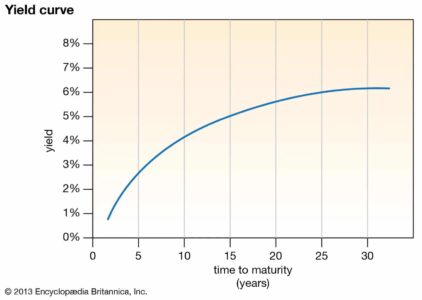

This is a term that relates to debt and buying bonds. You can think of the word ‘yield’ as the interest rate from a bond. A yield curve is a line on a graph that plots the interest rates on one axis and the maturity date on the other (for bonds of equal ratings).

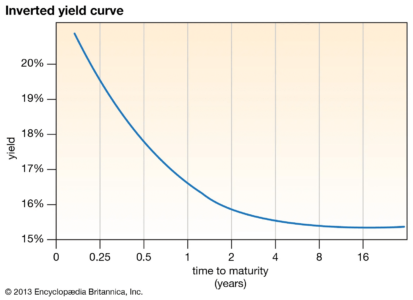

There are different types of yield curves:

They look like this:

It takes a while to wrap your head around, but don’t worry too much. What’s more important is that you understand what these different shapes can tell us about markets. Because sometimes they can predict economic changes.

Not quite a crystal ball, but they have been spookily accurate in the past.

This is when the yield curve on a graph is downward sloping. It means that interest rates on longer-term debt are lower than the interest rate (yield) for short-term debt of the same quality.

A scenario like this is unusual because in most cases, a longer timeframe means higher interest rates. But when a yield curve inverts, it means the opposite is true. Short-term rates are better than long-term rates. Still with me?

It would be like putting your money into a savings account with the bank. Then, they offer you a rate of 5% to lock away your funds for 1 year, or 1% to put away your cash for 5 years. Strange right? It’s the opposite of what you’d expect.

So, this is why an inverted yield curve can be a bad omen in the world of finance.

When you see mention of ‘the’ inverted yield curve, it’s often referring to the relationship between various US Treasury yields (interest rates on bonds from the American government).

The common comparison used is between the US 2-year and 10-year Treasury bonds. So, an inverted yield curve simple means:

This lack of confidence in the future is why this inversion can be a scary signal that a recession is on the way. It suggests a slowing economy, which can then develop into a recession.

We’ve also seen the interest rates (yields) invert on the 5-year and 30-year Treasuries. This naughty little sod has actually predicted 5 out of the last 6 recessions in the US (6 to 18 months after the yield curve inverts). The last time this happened was in 2006 – ouch.

Obviously the UK economy is separate to America’s. But, what happens across the pond tends to ripple all the way to our country of tea-drinkers and soap lovers. By which I mean TV soaps, I’m not insinuating Americans stink!

Now, this is where things get interesting. If you’re new to investing, or got started post-2008, you might be scared. You may even be shaking in your boots, consumed with fear about the ways in which a recession could impact your investment portfolio.

Well, I’m happy to be the bearer of good news. A recession doesn’t always mean losing money in the stock market!

In fact, since 1869 – there’s been a total of 30 recessions in the US. What may surprise you to hear is that in 16/30 of those, the US stock market saw positive returns (from the beginning of the recession to the end).

Even crazier is that during the 16 recessions of positive returns, the average return was 9.8% (ranging between 0.7% – 38.1%).

I know that was a lot of figures and stats thrown your way, but the takeaway is this:

A recession doesn’t mean your investments will lose value. In around 50% of past cases – you would have made money.

Although inflation and supply issues are leading to a cost of living crisis, there’s no guarantee that we’re due a UK recession in 2022.

Anyone who tells you they know exactly what’s going to happen to the economy and when it will happen is full of rubbish.

But, what history does show us is that recessions come along frequently. And on a positive note, they’re not the end of the world for investors.

You should make a note that although you can make money with investments during a recession, losing money is also a real possibility.

So, how do you maximise your upside and limit your potential downside? Diversify.

No one knows what investments will come out on top and which will suffer the most. Your best course of action is to create a diversified portfolio using the following steps:

After making sure you’re properly diversified, there are some other things you can do before, during, and after a recession:

This is not financial or investment advice. Remember to do your own research and speak to a professional advisor before parting with any money.

Direct to your inbox every week

New data capture form 2023

"*" indicates required fields

Leave a Reply